Why I Will Never Invest in Government Bonds

A classic strategy in the investing space is to split your capital between stocks and bonds. When you want to take more risk for greater rewards, you move more into stocks. When you want to pull back and take less risk then you move more into bonds. The idea is that bonds are a stable, predictable source of small returns. A safe haven in volatile markets. Sounds simple enough.

There are basically two types of bonds: corporate bonds and government bonds. Corporate bonds are a great idea. They are a stable source of income for cautious investors and they allow a corporation to borrow money at whatever rate of interest the market determines is appropriate given that company’s risk of going bankrupt.

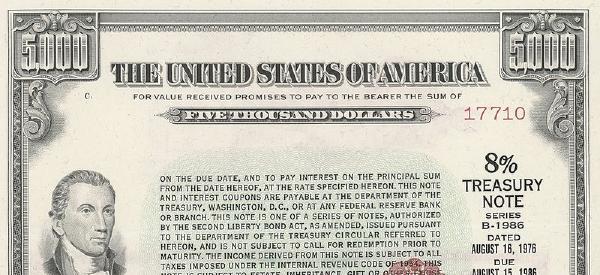

But many people will also look to government bonds. These are a terrible idea. On the surface the appeal is simple. The government is very unlikely to go “bankrupt” and fail to pay the debt. For this reason, many people regard government bonds as the “safest” bonds on the market. But the reason that the government is very unlikely to default on its debt obligations is because they don’t have to compete on the free market for their income. They get their income from taxes and inflation. Both of these are methods of stealing away the fruits of people’s labour without their consent.

The term “government bonds” makes them sound like legitimate financial assets. I have resolved to refer to them with a more accurate label. They are really slavery futures. They are an investment in the future oppression of your fellow human beings.

I will never have them in my investment portfolio. It does not matter how “safe” the returns are. They are immoral.